KYC/AML services

Regulatory requirements are constantly being improved, just as the world around us and KYC/AML rules in different countries are periodically changing. In order to meet the most modern requirements and be on the cutting edge of technology, Legex company has chosen the Sumsub solution and automates processes in all three main areas of compliance checks: KYC, KYB, and crypto monitoring.

Sumsub is one of the world leaders in the provision of automated counterparty verification services, transaction monitoring and prevention of money laundering and terrorist financing. Legex applies due diligence measures both when establishing business relationships and during the entire period of work with counterparties through constant monitoring.

Our Services

-

User Verification

-

Business verification

-

Transaction monitoring

-

Crypto assets check

-

Travel rule compliance

-

Integration with client systems

-

User Verification

-

Business verification

-

Transaction monitoring

-

Crypto assets check

-

Travel rule compliance

-

Integration with client systems

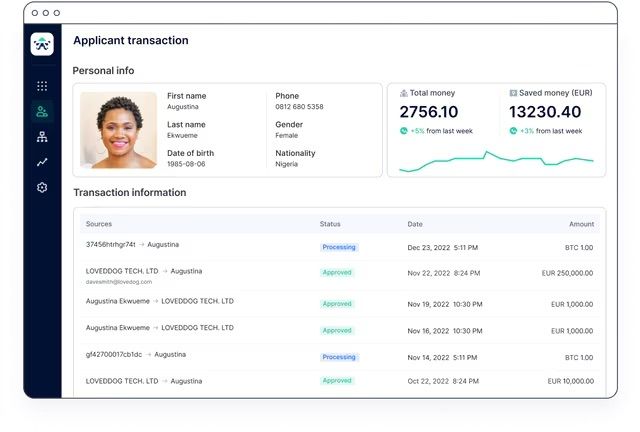

KYC (Know Your Client)

New users are checked for global sanctions, watch/block lists, PEP, and negative data in the media, as well as standard verification of documents and information, is carried out:

- Liveness and Face match

- ID verification

- Address verification

- Phone verification

- Email verification

- AML screening

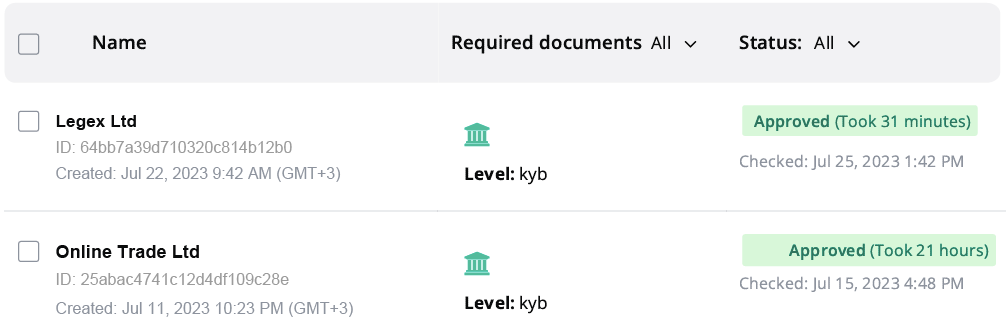

KYB (Know Your Business)

The KYB procedure has the same purpose as KYC, it is a way to assess the AML/CFT risks that new and existing business relationships pose and help determine whether the business is genuine or used to conceal the identity of the owners or business activity for illegal purposes.

Accordingly, the KYB procedure finds out the ultimate beneficiaries (UBOs) in order to understand who benefits from the financial activities of the enterprise. Checks are also being carried out to determine whether the company or its employees are subject to international sanctions, whether they have been subjected to political corruption, or have been the subject of news reports that may indicate their involvement in criminal activities.

For these purposes, the following corporate documents are collected and processed:

- Certificate of Incorporation/registration

- Memorandum and Articles of Association

- Documents, declared company beneficial owners and directors

- Certificate of Incumbency / Certificate of Good Standing

- Extracts from the state register of legal entities

- Сomplete shareholding structure with the country(ies) of incorporation and showing UBOs (more than 10%)

- Proof of Identity of each director and beneficial owner (passport/ID)

- Proof of address of each director and beneficial owner (utility bill/bank statement no older than 3 months)

- Company’s bank statements for last 3-6 months

- Proof of actual business address (utility bill no older than 3 months or actual rent agreement, invoices, and payments proof)

- Agreements with main partners

- UBOs proof of well-being – bank statement for the last 3-6 months confirming source of funds, tax declaration, savings, income from rent, paid dividends, etc.

- For regulated business: copy of the license, signed AML policy and KYC procedures in place for onboarding and monitoring their own customers

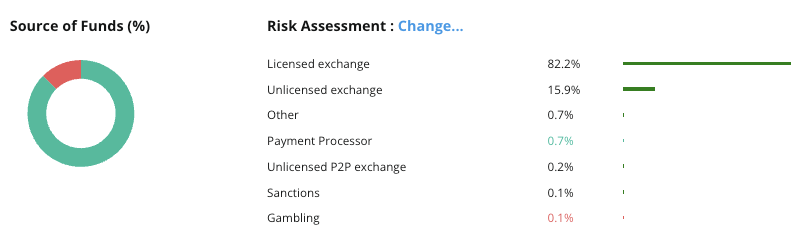

Crypto transaction check

Crypto transaction check

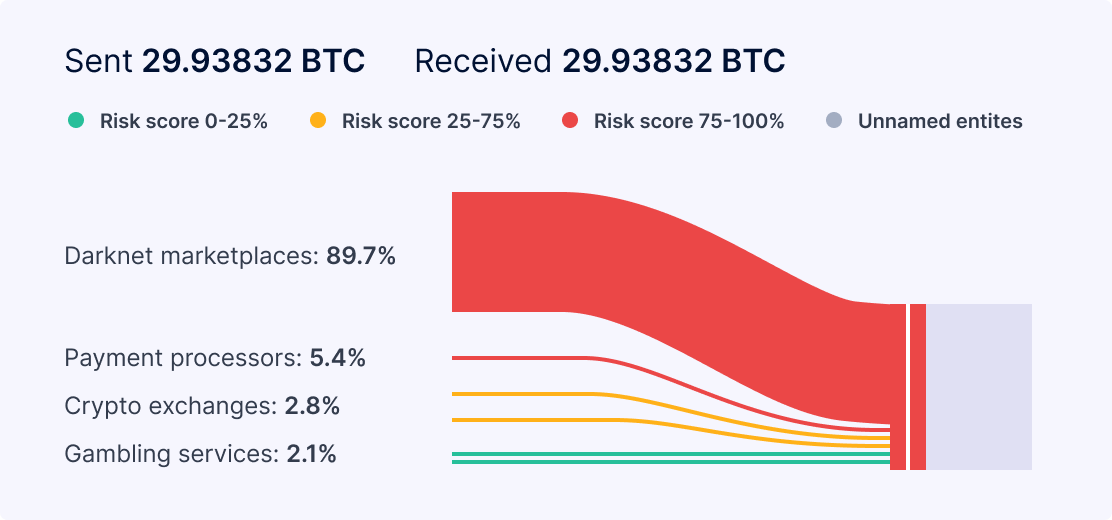

The Sumsub Crypto compliance solution is used to detect and prevent financial crimes using crypto assets.

The system allows you to check for the ”toxicity" of most major cryptocurrencies, make a risk assessment for working with them, save the results of the study in a detailed report with a graphical representation of the data, and monitor assets over time.

This is not just a technology platform, but a legally equipped, customer-oriented system for verifying compliance with AML, FATF, and FinCEN requirements, and recognized by most regulatory authorities and financial institutions.

Sumsub also complies with the Crypto Travel Rule (FATF Recommendation #16) that requires VASPs and financial institutions engaged in virtual asset transfers to collect and share the personal data of transaction originators and beneficiaries.

For companies that use crypto in their settlements with counterparties, it is important to safeguard reputation by processing only non-toxic crypto funds.

What about the price

- £500 manual check with source of funds

- £100 for business verification

- £10 for user verification

- £1 for crypto asset check